Copper Prices Rise, Offering Opportunities

Copper prices are rising. A metal price that has long been in decline has reversed its trend in the past three weeks.

What's up with this? That is what this article will explore. Current investment opportunities are evaluated and actionable suggestions provided.

The Price Trends

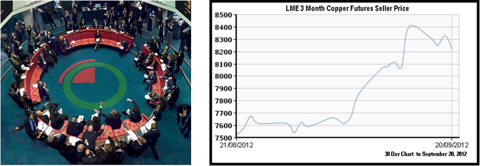

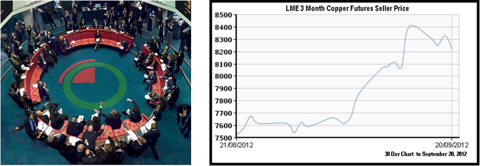

Copper is a commodity, and trades on a number of global markets. One of these is the London Metal Exchange (LME) where at 56 Leadenhall Street in London each weekday traders set the future prices on copper and other base metals in an open-outcry trading pit, as pictured . Last week alone, saw a 2.8 percent increase on the LME to $8,330 per metric ton. This translates into about $3.79 a pound, in U.S. measurements. This is the third weekly increase on the exchange. As with all commodities, the price is subject to the economic forces of supply and demand.

(Click to enlarge)

Supply and Demand

The price of copper slid in the past year for one simple reason, supply was steady and because of a decrease in construction and manufacturing activity caused by the lingering recession, demand was soft. This was especially true in China, where the increase in the rate of GNP annual gain declined. Fitch, the global ratings service, reports, "China's efforts to curb property speculation and inflation have resulted in slowing industrial production and metals demand growth. The government's target for 2012 Gross Domestic Product (GDP) growth is 7.5% compared with actual growth of 9.2% in 2011." This is important because China accounts for 43% of the world copper consumption.

A GNP increase of 7.5% is sizable compared to the anemic U.S. GNP growth and the flat European performance. While the supply of copper remains static, demand has started to outstrip supply. Buffering this demand, temporarily, is the amount of supply that copper users have in stock. China is the wildcard in this; they do not release timely and accurate inventory numbers as other producers and users do. Speculation is that they were "in-stocking" during the first half of 2012, which would imply lessened demand through the end of the year.

Last week the International Copper Study Group (ICSG) released its 2012 Statistical Yearbook covering world copper supply and demand. The long-term trend in copper usage is up, and demand increased at the rate of 3% a year for the last 10 years. There is consensus in the industry that this will continue due to increasing urbanization in China and other countries and demand from construction and infrastructure build-out in other emerging markets. China's manufacturing sector will continue to be an important consumer. Over the last 10-year period, China's usage increased by 185% and its share of world usage grew to over 40% from 18% in 2002.

Shorter term, supply is lagging usage more than was expected, and more than it was last year at this time. According to ICSG, the refined copper market balance for the first half 2012 indicates a seasonally adjusted deficit of 292,000 tonnes. This is in light of a forecast shortage for 2012 of 237,000 tonnes for the whole year. According to an analysis byInfoMines, "Supply in the global copper market has long been tight and is getting tighter. Primary mine production grew just 2.4% in H1 2012, but global usage expanded 7.3%, mainly thanks to Chinese imports which ICGS notes could be a factor of stockpiling not actual usage."

While it might seem that this is a time for expansion by miners, shareholder concerns about large CAPEX budgets has quelled that option for this year. Some capacity will come on-line in 2013, notably Rio Tinto's (RIO) huge new mine at Oyu Tolgoi in Mongolia; it will not be enough to cause a surplus.

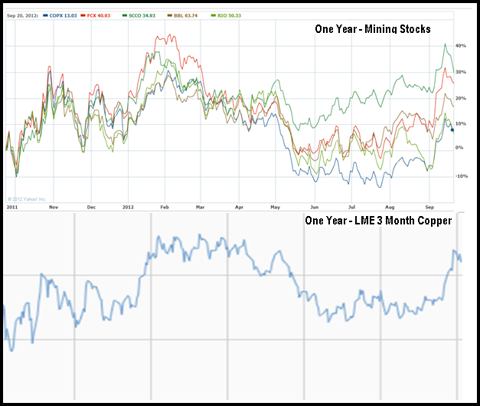

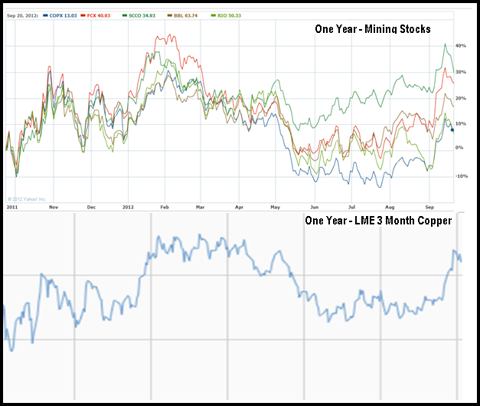

(Click to enlarge)

The Opportunity

It is obvious from a look at the above chart that the price of copper is a strong factor in determining the value of copper miners. There was a pullback from Wednesday's enthusiasm, which stemmed from the release of the ICSG report; it looks like a minor correction in a longer upward move. Perhaps traders were taking some profits and confirmation of the trend will be apparent this week.

The largest movers on the copper price increase were the pure plays, Freeport McMoRan Copper and Gold (FCX) and Southern Mining Company (SCCO). The large copper producing multi-product miners, BHP Billiton (BBL) and Rio Tinto followed with smaller increases.

Southern Copper Company

Southern Copper Corporation is one of the largest integrated copper producers in the world and has the largest copper reserves of the industry. Southern Copper registered as a U.S. corporation in Arizona, and has its operating headquarters in Lima, Peru. They are a NYSE and Lima Stock Exchange listed company that is 81% owned by Grupo Mexico, a Mexican company listed on the Mexican Stock Exchange. Minority shareholders have a concern that Grupo Mexico may not always act in their best interests.

SCCO operates mining units and metallurgical facilities in Mexico and Peru and conducts exploration activities in Argentina, Chile, Ecuador, Mexico and Peru. Violent labor strikes and disruptive environmental actions are a part of the history of mining in these countries. However, for the most part, operations continue smoothly. The huge historic open-pit mines in these venues are rich in quality ore and are efficient; SCCO has a cost advantage over the competition. Therefore, with the lowest cost of any major producer it can make a profit should copper fall from its "new normal" price in the $3 plus range.

In a SeekingAlpha article Saturday, Efsinvestment offered a discounted cash flow study presenting a valuation of Southern Copper. "According to my 5-year discounted-earnings-plus-book-value model, the fair-value range for SCCO is between $37 and $42 per share. At a price of about $35, Southern Copper is trading at a discount. The stock has at least 8% upside potential to reach its fair value."

Its P/E is 13.3 compared to a historical average of 16.4 (data: FASTGraphs), which would indicate a slight undervaluation, and possibly put a target at around 40. Of course, differences of opinion make a market. Morningstar, on the other hand, gives it a fair value estimate of only $25.00 and grants the firm only two stars.

While SCCO has been a veritable cash cow in times past, their current divided is a quarterly $0.24/share, $0.96 annually if they maintain that rate. That translates into a yield of only 2.7% compared to its trailing dividend of 4.7%. It has a very spotty dividend history marked by large increases and decreases.

Thompson-Reuters lists SCCO at the bottom of its analyst ratings of large cap miners, with a Hold rating of 2.9

Freeport McMoRan Copper and Gold

Freeport-McMoRan Copper & Gold Inc. is the world's largest publicly traded copper company. They mine geographically diverse, long-lived reserves of copper, gold and molybdenum. They are the largest copper producer in North America, and more than a third of their almost 4 billion pounds of global sales come from this continent. Their operations in North America are all open pit mines that utilize a combination of concentrating, leaching, solution extraction and electrical refining facilities to recover copper. Their Morenci mine in eastern Arizona continues to increase its production rate through expansion and productivity increases.

Freeport, like Southern Copper Company, has the bulk of its resources in another country, in this case Indonesia. The Grasberg Mine in that country is the world's largest copper and gold mine in terms of recoverable reserves. Other productive properties are located at the Cerro Verde and El Abra operations in South America and the Tenke Fungurume minerals district in the Democratic Republic of Congo.

There was a long and sometimes bloody strike in Indonesia last year, and this resulted in significant downtime for the Grasberg mine. While that mine is fully operational now, all is not well in that country. It is not clear at this writing if Freeport will be exempt from last week's increase in Indonesian mining tariffs. It has held in the past that its extraction fees are contractually set at lower levels, which exempts the company from increases at the present.

In February, the company increased its regular quarterly dividend from an annual rate of $1.00 to $1.25 a share. At today's price of about $40, this gives it a yield of 3.12%. It typically will add a special annual dividend to this in good years. This makes the ups and downs of its annual dividend payout appear more uneven than they really are.

The company currently has a trailing P/E of 10.5, a forward P/E of 9.0, which compared to its long term historical P/E rate of 18.5 is an indication of undervaluation, perhaps by as much as $20 a share. This would place it in the $60 target range. Carrying only a 16% debt load, Freeport is a low cost producer with much to gain if copper prices continue up. However, Morningstar gives it a fair value estimate of only $39, and a rating of 3 stars.

Thompson-Reuters consensus analyst rating is at 1.9, among its highest current ratings for large cap miners and a Buy.

BHP Billiton

BPH Billiton is the world's largest miner. Unlike the above two companies, it is a diversified miner with interests in not only base metals, copper being the primary one in that group, but also iron ore, energy coal, metallurgical coal, manganese, natural gas, oil and uranium. It invests in large, low cost, long life upstream assets diversified by product, geography and market. It has 38 mining operations worldwide, and these are located, in most cases, in safe environments with well-developed infrastructures.

The company has a stated purpose of creating shareholder value through the acquisition, development and marketing of natural resources. With over 100 locations in 25 countries, they make significant contributions to many communities, not only in the form of employment but also in the form of community grants which totaled over $200 million in 2012. While earnings were down in the fiscal year ending on June 30, margins continued at the same rate of 39%.

While the downturn in business caused them to shelve, at least temporarily, their commitment to the South Australian copper and uranium project at Olympic Dam, it has not dampened their enthusiasm for the future. In the annual report, Chairman Jac Nasser states:

"Your Board is confident that our commitment to invest in high-return growth opportunities will continue to create returns for shareholders. Our largely brownfield projects in execution will continue to drive momentum in our major businesses and create value for our shareholders in the near term. Moreover, the continued urbanization and industrialization of developing economies should support both demand for our products and the long-term growth of our strong pipeline of development projects across diverse commodities and geographies.

Recognizing these opportunities, we will continue to prioritize investment where a sustainable competitive advantage exists, including geopolitical and fiscal stability. Our project approvals process will ensure that we allocate capital in a disciplined fashion, while the quality and diversity of our asset portfolio will continue to drive strong returns.

Investing in high-return projects, while maintaining a strong balance sheet, underpins our ability to pay a dividend that grows over time. This financial year our progressive dividend increased to 112 U.S. cents per share. Over the last 10 years, we have returned approximately U.S. $54 billion to shareholders through dividends and share buy-backs. That represents around 30 per cent of the group's current market capitalization. Moreover, our unbroken dividend generates a yield that is well in excess of our peer group."

CEO Marius Kloppers and an involved Board of Directors do an excellent job of managing the firm while keeping it on track to fulfill its mission. The company handles its relatively small debt load (27%) very well and has an excellent credit rating. Returns on invested capital have averaged 25% during the past five years. Current yield is 3.54%. The five-year average EBITDA margin is a very healthy 45%.

BHP Billiton has a market capitalization of $164 Billion and sales of over $72 Billion in the past 12 months. Its current P/E is just under 10, well below its long-term average of 14. This would indicate undervaluation on the order of 30%, which would give it a valuation of $81. Morningstar places its fair value at $86 and gives it 4 stars.

Thompson-Reuters analyst consensus is 2.1, in Buy territory.

Rio Tinto

Rio Tinto is a world leader in finding, mining and extracting the world's mineral resources. A current point of pride is that they were chosen to supply the metals to make the 2012 Olympics' 4,700 Gold, Silver and Bronze medals. They can also point to the fact that the source of these metals was from North America's largest open pit operation, the Kennecott Mine in Utah, and one of today's largest mining developments at Oyu Tolgoi in Mongolia. The company assets also include development and mines in Australia, Mozambique and Guiana.

Rio is a diversified miner and a world-class competitor along with BHP Billiton, Vale (VALE) and Anglo American (AAUKY.PK). Second only to BHP Billiton in product and geographical diversity, RIO is, however, more susceptible to the wide swings in the coal and iron ore markets.

Like BHP Billiton, Rio has a progressive dividend policies designed to remove volatility from the dividend amount. The current yield is 3.32%. In the last decade of very strong earnings growth, annual dividend increases for BHP averaged 25% and for Rio 14%. However, Rio was coming from a higher dividend base and payout ratio early last decade.

The current price of RIO is about $49, which is not only way below Morningstar's fair value price of $75 but also below their suggested buy price of $52.50. Therefore, they award it 5 stars.

Thomson-Reuters analysts' consensus also reflects the opportunity with a rating of 1.8, a Buy and the strongest rating of 15 large cap miners.

Action

Is copper a leading indicator? The rising copper price, if it continues, could portend increased global economic activity. For the mining stock investor, owners of any of the four above frequently traded NYSE listed companies above should profit. In general, a company that is a pure play in a metal with a rising price has the best upside. The impact on a diversified miner is less as diversity leads to stability in earnings, both on the upside and downside. Rio Tinto is clearly the most undervalued at present and for that reason alone, it is a buy. Longer term, I believe BBL is the better-positioned company. I conclude that the best alternatives today are:

Buy FCX

Buy RIO

Please refer to my SeekingAlpha articles list for numerous other articles on mining, copper and the companies in this article.

What's up with this? That is what this article will explore. Current investment opportunities are evaluated and actionable suggestions provided.

The Price Trends

Copper is a commodity, and trades on a number of global markets. One of these is the London Metal Exchange (LME) where at 56 Leadenhall Street in London each weekday traders set the future prices on copper and other base metals in an open-outcry trading pit, as pictured . Last week alone, saw a 2.8 percent increase on the LME to $8,330 per metric ton. This translates into about $3.79 a pound, in U.S. measurements. This is the third weekly increase on the exchange. As with all commodities, the price is subject to the economic forces of supply and demand.

(Click to enlarge)

Supply and Demand

The price of copper slid in the past year for one simple reason, supply was steady and because of a decrease in construction and manufacturing activity caused by the lingering recession, demand was soft. This was especially true in China, where the increase in the rate of GNP annual gain declined. Fitch, the global ratings service, reports, "China's efforts to curb property speculation and inflation have resulted in slowing industrial production and metals demand growth. The government's target for 2012 Gross Domestic Product (GDP) growth is 7.5% compared with actual growth of 9.2% in 2011." This is important because China accounts for 43% of the world copper consumption.

A GNP increase of 7.5% is sizable compared to the anemic U.S. GNP growth and the flat European performance. While the supply of copper remains static, demand has started to outstrip supply. Buffering this demand, temporarily, is the amount of supply that copper users have in stock. China is the wildcard in this; they do not release timely and accurate inventory numbers as other producers and users do. Speculation is that they were "in-stocking" during the first half of 2012, which would imply lessened demand through the end of the year.

Last week the International Copper Study Group (ICSG) released its 2012 Statistical Yearbook covering world copper supply and demand. The long-term trend in copper usage is up, and demand increased at the rate of 3% a year for the last 10 years. There is consensus in the industry that this will continue due to increasing urbanization in China and other countries and demand from construction and infrastructure build-out in other emerging markets. China's manufacturing sector will continue to be an important consumer. Over the last 10-year period, China's usage increased by 185% and its share of world usage grew to over 40% from 18% in 2002.

Shorter term, supply is lagging usage more than was expected, and more than it was last year at this time. According to ICSG, the refined copper market balance for the first half 2012 indicates a seasonally adjusted deficit of 292,000 tonnes. This is in light of a forecast shortage for 2012 of 237,000 tonnes for the whole year. According to an analysis byInfoMines, "Supply in the global copper market has long been tight and is getting tighter. Primary mine production grew just 2.4% in H1 2012, but global usage expanded 7.3%, mainly thanks to Chinese imports which ICGS notes could be a factor of stockpiling not actual usage."

While it might seem that this is a time for expansion by miners, shareholder concerns about large CAPEX budgets has quelled that option for this year. Some capacity will come on-line in 2013, notably Rio Tinto's (RIO) huge new mine at Oyu Tolgoi in Mongolia; it will not be enough to cause a surplus.

(Click to enlarge)

The Opportunity

It is obvious from a look at the above chart that the price of copper is a strong factor in determining the value of copper miners. There was a pullback from Wednesday's enthusiasm, which stemmed from the release of the ICSG report; it looks like a minor correction in a longer upward move. Perhaps traders were taking some profits and confirmation of the trend will be apparent this week.

The largest movers on the copper price increase were the pure plays, Freeport McMoRan Copper and Gold (FCX) and Southern Mining Company (SCCO). The large copper producing multi-product miners, BHP Billiton (BBL) and Rio Tinto followed with smaller increases.

Southern Copper Company

Southern Copper Corporation is one of the largest integrated copper producers in the world and has the largest copper reserves of the industry. Southern Copper registered as a U.S. corporation in Arizona, and has its operating headquarters in Lima, Peru. They are a NYSE and Lima Stock Exchange listed company that is 81% owned by Grupo Mexico, a Mexican company listed on the Mexican Stock Exchange. Minority shareholders have a concern that Grupo Mexico may not always act in their best interests.

SCCO operates mining units and metallurgical facilities in Mexico and Peru and conducts exploration activities in Argentina, Chile, Ecuador, Mexico and Peru. Violent labor strikes and disruptive environmental actions are a part of the history of mining in these countries. However, for the most part, operations continue smoothly. The huge historic open-pit mines in these venues are rich in quality ore and are efficient; SCCO has a cost advantage over the competition. Therefore, with the lowest cost of any major producer it can make a profit should copper fall from its "new normal" price in the $3 plus range.

In a SeekingAlpha article Saturday, Efsinvestment offered a discounted cash flow study presenting a valuation of Southern Copper. "According to my 5-year discounted-earnings-plus-book-value model, the fair-value range for SCCO is between $37 and $42 per share. At a price of about $35, Southern Copper is trading at a discount. The stock has at least 8% upside potential to reach its fair value."

Its P/E is 13.3 compared to a historical average of 16.4 (data: FASTGraphs), which would indicate a slight undervaluation, and possibly put a target at around 40. Of course, differences of opinion make a market. Morningstar, on the other hand, gives it a fair value estimate of only $25.00 and grants the firm only two stars.

While SCCO has been a veritable cash cow in times past, their current divided is a quarterly $0.24/share, $0.96 annually if they maintain that rate. That translates into a yield of only 2.7% compared to its trailing dividend of 4.7%. It has a very spotty dividend history marked by large increases and decreases.

Thompson-Reuters lists SCCO at the bottom of its analyst ratings of large cap miners, with a Hold rating of 2.9

Freeport McMoRan Copper and Gold

Freeport-McMoRan Copper & Gold Inc. is the world's largest publicly traded copper company. They mine geographically diverse, long-lived reserves of copper, gold and molybdenum. They are the largest copper producer in North America, and more than a third of their almost 4 billion pounds of global sales come from this continent. Their operations in North America are all open pit mines that utilize a combination of concentrating, leaching, solution extraction and electrical refining facilities to recover copper. Their Morenci mine in eastern Arizona continues to increase its production rate through expansion and productivity increases.

Freeport, like Southern Copper Company, has the bulk of its resources in another country, in this case Indonesia. The Grasberg Mine in that country is the world's largest copper and gold mine in terms of recoverable reserves. Other productive properties are located at the Cerro Verde and El Abra operations in South America and the Tenke Fungurume minerals district in the Democratic Republic of Congo.

There was a long and sometimes bloody strike in Indonesia last year, and this resulted in significant downtime for the Grasberg mine. While that mine is fully operational now, all is not well in that country. It is not clear at this writing if Freeport will be exempt from last week's increase in Indonesian mining tariffs. It has held in the past that its extraction fees are contractually set at lower levels, which exempts the company from increases at the present.

In February, the company increased its regular quarterly dividend from an annual rate of $1.00 to $1.25 a share. At today's price of about $40, this gives it a yield of 3.12%. It typically will add a special annual dividend to this in good years. This makes the ups and downs of its annual dividend payout appear more uneven than they really are.

The company currently has a trailing P/E of 10.5, a forward P/E of 9.0, which compared to its long term historical P/E rate of 18.5 is an indication of undervaluation, perhaps by as much as $20 a share. This would place it in the $60 target range. Carrying only a 16% debt load, Freeport is a low cost producer with much to gain if copper prices continue up. However, Morningstar gives it a fair value estimate of only $39, and a rating of 3 stars.

Thompson-Reuters consensus analyst rating is at 1.9, among its highest current ratings for large cap miners and a Buy.

BHP Billiton

BPH Billiton is the world's largest miner. Unlike the above two companies, it is a diversified miner with interests in not only base metals, copper being the primary one in that group, but also iron ore, energy coal, metallurgical coal, manganese, natural gas, oil and uranium. It invests in large, low cost, long life upstream assets diversified by product, geography and market. It has 38 mining operations worldwide, and these are located, in most cases, in safe environments with well-developed infrastructures.

The company has a stated purpose of creating shareholder value through the acquisition, development and marketing of natural resources. With over 100 locations in 25 countries, they make significant contributions to many communities, not only in the form of employment but also in the form of community grants which totaled over $200 million in 2012. While earnings were down in the fiscal year ending on June 30, margins continued at the same rate of 39%.

While the downturn in business caused them to shelve, at least temporarily, their commitment to the South Australian copper and uranium project at Olympic Dam, it has not dampened their enthusiasm for the future. In the annual report, Chairman Jac Nasser states:

"Your Board is confident that our commitment to invest in high-return growth opportunities will continue to create returns for shareholders. Our largely brownfield projects in execution will continue to drive momentum in our major businesses and create value for our shareholders in the near term. Moreover, the continued urbanization and industrialization of developing economies should support both demand for our products and the long-term growth of our strong pipeline of development projects across diverse commodities and geographies.

Recognizing these opportunities, we will continue to prioritize investment where a sustainable competitive advantage exists, including geopolitical and fiscal stability. Our project approvals process will ensure that we allocate capital in a disciplined fashion, while the quality and diversity of our asset portfolio will continue to drive strong returns.

Investing in high-return projects, while maintaining a strong balance sheet, underpins our ability to pay a dividend that grows over time. This financial year our progressive dividend increased to 112 U.S. cents per share. Over the last 10 years, we have returned approximately U.S. $54 billion to shareholders through dividends and share buy-backs. That represents around 30 per cent of the group's current market capitalization. Moreover, our unbroken dividend generates a yield that is well in excess of our peer group."

CEO Marius Kloppers and an involved Board of Directors do an excellent job of managing the firm while keeping it on track to fulfill its mission. The company handles its relatively small debt load (27%) very well and has an excellent credit rating. Returns on invested capital have averaged 25% during the past five years. Current yield is 3.54%. The five-year average EBITDA margin is a very healthy 45%.

BHP Billiton has a market capitalization of $164 Billion and sales of over $72 Billion in the past 12 months. Its current P/E is just under 10, well below its long-term average of 14. This would indicate undervaluation on the order of 30%, which would give it a valuation of $81. Morningstar places its fair value at $86 and gives it 4 stars.

Thompson-Reuters analyst consensus is 2.1, in Buy territory.

Rio Tinto

Rio Tinto is a world leader in finding, mining and extracting the world's mineral resources. A current point of pride is that they were chosen to supply the metals to make the 2012 Olympics' 4,700 Gold, Silver and Bronze medals. They can also point to the fact that the source of these metals was from North America's largest open pit operation, the Kennecott Mine in Utah, and one of today's largest mining developments at Oyu Tolgoi in Mongolia. The company assets also include development and mines in Australia, Mozambique and Guiana.

Rio is a diversified miner and a world-class competitor along with BHP Billiton, Vale (VALE) and Anglo American (AAUKY.PK). Second only to BHP Billiton in product and geographical diversity, RIO is, however, more susceptible to the wide swings in the coal and iron ore markets.

Like BHP Billiton, Rio has a progressive dividend policies designed to remove volatility from the dividend amount. The current yield is 3.32%. In the last decade of very strong earnings growth, annual dividend increases for BHP averaged 25% and for Rio 14%. However, Rio was coming from a higher dividend base and payout ratio early last decade.

The current price of RIO is about $49, which is not only way below Morningstar's fair value price of $75 but also below their suggested buy price of $52.50. Therefore, they award it 5 stars.

Thomson-Reuters analysts' consensus also reflects the opportunity with a rating of 1.8, a Buy and the strongest rating of 15 large cap miners.

Action

Is copper a leading indicator? The rising copper price, if it continues, could portend increased global economic activity. For the mining stock investor, owners of any of the four above frequently traded NYSE listed companies above should profit. In general, a company that is a pure play in a metal with a rising price has the best upside. The impact on a diversified miner is less as diversity leads to stability in earnings, both on the upside and downside. Rio Tinto is clearly the most undervalued at present and for that reason alone, it is a buy. Longer term, I believe BBL is the better-positioned company. I conclude that the best alternatives today are:

Buy FCX

Buy RIO

Please refer to my SeekingAlpha articles list for numerous other articles on mining, copper and the companies in this article.

seekingalpha.com

Bob Johnson

Bob Johnson

Comments

Post a Comment