COLOMBIA RENEWS CONTROVERSIAL MINING CONTRACT WITH BHP

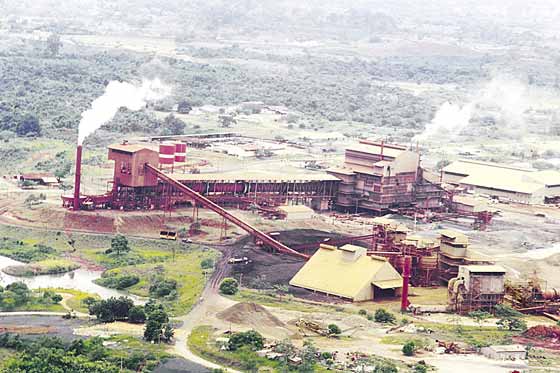

The debated contract, that has Colombian authorities divided over the terms under which BHP Billiton (NYSE:BHP) should operate the Cerro Matoso nickel mine, found a momentary solution this week after the government decided to extend the mining deal until 2029.

The Anglo-Australian company has two contracts that expire this Sunday, but the Ministry of Mines and Energy (Minminas) decided that a third will remain in effect, said the authority in a statement (Spanish only).

Minister Federico Renjifo, however, said the country will not give up on the yearlong negotiations with BHP, and that it giving the company only three more months to come up with a new proposal for the out-dated deal.

Signed in 1996, the contract allows the BHP to mine ferronickel in the northwestern region of Cordoba. The authority is demanding a revision that takes into account new international standards and mining legislation and presents a better deal for the country in terms of royalties.

Renjifo added thee National Mining Agency will take charge of “analyzing the new economic conditions of the deal … under the premise that the country can get the most benefit under the new contract terms,” said the minister.

According to Radio Caracol, workers in the mine want social investment issues to be included in the agreement, while the governor of Cordoba insists that local officials should be part of the negotiations.

Last year Cerro Matoso was forced to pay the state nearly $20 million in royalties and unpaid taxes that should have been paid in 2008 and 2009, following an audit by the Colombian Comptroller General’s Office.

The mine produces 4% of the world’s ferronickel, which is used mostly in the manufacturing of stainless steel and other heat-resistant steel products, as well as in batteries, electronics and aerospace applications. Cerro Matoso has a reserve life of about 40 years and it’s expected to produce 51,100 tons of the metal this year.

The Anglo-Australian company has two contracts that expire this Sunday, but the Ministry of Mines and Energy (Minminas) decided that a third will remain in effect, said the authority in a statement (Spanish only).

Minister Federico Renjifo, however, said the country will not give up on the yearlong negotiations with BHP, and that it giving the company only three more months to come up with a new proposal for the out-dated deal.

Signed in 1996, the contract allows the BHP to mine ferronickel in the northwestern region of Cordoba. The authority is demanding a revision that takes into account new international standards and mining legislation and presents a better deal for the country in terms of royalties.

Renjifo added thee National Mining Agency will take charge of “analyzing the new economic conditions of the deal … under the premise that the country can get the most benefit under the new contract terms,” said the minister.

According to Radio Caracol, workers in the mine want social investment issues to be included in the agreement, while the governor of Cordoba insists that local officials should be part of the negotiations.

Last year Cerro Matoso was forced to pay the state nearly $20 million in royalties and unpaid taxes that should have been paid in 2008 and 2009, following an audit by the Colombian Comptroller General’s Office.

The mine produces 4% of the world’s ferronickel, which is used mostly in the manufacturing of stainless steel and other heat-resistant steel products, as well as in batteries, electronics and aerospace applications. Cerro Matoso has a reserve life of about 40 years and it’s expected to produce 51,100 tons of the metal this year.

Comments

Post a Comment