Copper-bottomed

Copper continues to experience strong demand and its disinfectant capabilities look set to see its use in the health industry increase significantly. John Chadwick examines latest technologies to extract copper

Copper continues to experience strong demand and its disinfectant capabilities look set to see its use in the health industry increase significantly. John Chadwick examines latest technologies to extract copper Anything copper-bottomed today is most likely to be a saucepan. This idiomatic phrase has its origins in the 18th century when it described ships that were fitted with copper plating on the underside of their hulls. The process was first used on ships of the British Navy in 1761 to defend their wooden planking against attack by Teredo worms and to reduce infestations by barnacles.

Ironically, the metal known for its versatility in industrial applications from pipes and plumbing in the home to electrical wiring in power cables to cell phone components and much more saw a significant achievement when involved in the rescue of some copper mines. The 33 miners trapped underground last year in Chile were given copper socks to help keep them healthy. Copper’s germfighting quality helped keep the trapped miners free of foot infections in the warm, humid mine, according to a recent Mineweb article.

Now, clinical evidence shows hospitals can reduce infections by using copper touchsurfaces for everything from intravenous poles to over-the-patient tables, bed rails, door knobs and the nurse’s call button. With deadly, drug-resistant bacteria on the rise, researchers have been seeking new ways to fight hospitalacquired infections, the fourth biggest cause of death in the US behind heart disease, strokes and cancer.

Compare the cost of using such copper touch-surfaces with the cost of $45 billion per year to treat hospital-acquired infections in the US alone, which kill more than 100,000 people a year. The future may indeed be copperbottomed!

Copper, whose anti-bacterial properties have been given certification from the US government, releases ions that penetrate bacteria and bind to their enzymes and proteins, disabling them. Steel, the material used in most hospitals, does not.

At the Copper Hospital in the mining city of Calama in Chile’s far north, head nurse Alicia Gutierrez witnessed a sharp drop in infections after copper plating was installed in some intensive care units. “We’ve seen how these surfaces have helped cut the number of infections here,” she said. “I wish everyone could see it and appreciate how it can save lives.” A trial at the hospital, which treats Codelco mine workers, showed copper surfaces killed over 82% of bacteria within hours. Other studies show copper killed over 90% of bacteria.

Copper producers estimate between 250,000 t to 1 Mt/year in additional copper demand stemming from anti-bacterial uses, or about 5% of world mined copper output. “It’s an exciting opportunity for the industry to have applications in hospitals and clinics, but also in public buildings in general,” Richard Adkerson, chief executive of Freeport, told Reuters in March.

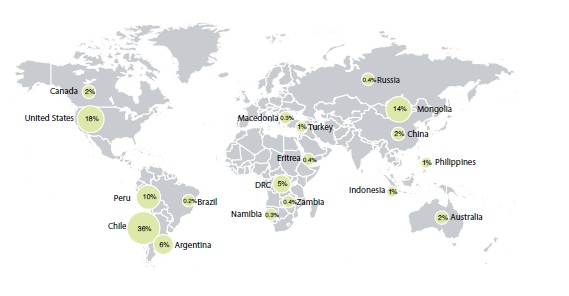

According to Glen Jones (Intierra Resource Intelligence) presentation Copper: The Project Pipeline at the International Copper Study Group meeting in April 2011 in Lisbon, Portugal, there are some 7,600 copper projects in the world – see chart of the top ten countries – second only to gold.

According to preliminary International Copper Study Group (ICSG) data, the refined copper market balance for March 2011 showed a small production surplus of 18,000 t. When making seasonal adjustments for world refined production and usage, March showed a larger surplus of 33,000 t. The apparent refined copper balance for the first quarter 2011, including revisions to data previously presented, indicates a production deficit of 33,000 t (a seasonally adjusted deficit of 16,000 t). This compares with a production surplus of 10,000 t (a seasonally adjusted surplus of about 42,000 t) in the same quarter of 2010.

During the first quarter of 2011, world apparent usage grew by 2.4% compared with that in the first quarter of 2010: A 90% Russian growth and growth of around 4% each in the European Union, Japan and the US were partially offset by a decline of 6% in China’s apparent usage. (China’s apparent copper usage is based only on reported data (production + net trade ± SHFE stock changes ± industry stock changes, if reported) and does not take into account changes in unreported stocks [State Reserve Bureau, producer, consumer and merchant/trader], which may be significant during periods of stocking or destocking.)

China’s apparent usage decline in the first quarter 2011 reflects a 31% decrease in refined copper net imports from those in the first quarter of 2010, and the increase in Russia’s apparent usage reflected a 65% decline in net refined exports. On a regional basis, usage grew by 2.1% in Africa, 4.6% in the Americas, 10.9% in Europe, and 35% in Oceania and declined by 1.6% in Asia.

World mine production grew by around 2.5% (93,000 t) in the first quarter of 2011 compared with that in the same quarter of 2010: Concentrate production grew by 3.8% while SX-EW declined by 2.4%. In part, this relative increase reflects operational constraints that reduced production in 2010 in Australia and Mexico. Production in Chile, the world’s leading producer, was down by 0.7%.

Production was also down in other major producers such as the US (-3.5%), Indonesia (-18%) and the DRC (-16%). On a regional basis, mine production increased by 1.2% in the Americas, 7% in Europe, and 24% in Oceania but decreased by 1% in both Africa and Asia. The mine capacity utilisation rate increased slightly in March and the average for the 1st quarter of 2011 was practically unchanged from that in the same quarter of 2010.

During that first quarter, world refined production grew by 1.5% as compared with that in the same quarter of 2010: Primary output increased by 1.2% and secondary production (from scrap) increased by 2.7%. Production increases of 71% in Australia (recovery from low 2010 level), 11% in China, and 6% in India were partially offset by declines in Chile (-3.5%), the US (-12%), Canada (-27%) and Japan (-12%). Refined production capacity utilisation in the first quarter of 2011 was around 78% as compared with 79% in the same quarter of 2010.

The average LME cash price for May 2011 was $8,927.05/t, down from the April 2011 average of $9,483.25/t. The 2011 high and low copper prices through the end of May were $10,148 and $8,536.5/t, respectively, and the average was $9,147.26/t. As of the end of May, copper stocks held at the major metal exchanges (LME, COMEX, SHFE) totalled 626,651 t, an increase of 58,469 t from stocks held at the end of December 2010. Compared to the March levels, stocks were up at LME and down at Comex and SHFE – www.icsg.org.

According to ICSG data, global growth in copper demand for 2011 is expected to exceed global growth in copper production and the annual production deficit, estimated at about 250,000 t of refined copper in 2010, is expected to be about 380,000 t in 2011. In response to prevailing high copper prices and increased end use demand, production increases are expected at operations curtailed following the 2008 economic crisis and, to a lesser extent, from startup of new operations.

Industrial demand in 2011 in all of the major consuming regions is expected to continue the upward trend begun in 2010 and exceed the growth in refined production. Following a year of extraordinary growth (38%) in 2009, China´s apparent consumption in 2010 grew by only 4.3% and accounted for more than 38% of global copper demand. In 2011, the growth rate is projected to be around 6%: an anticipated growth in semi-fabricate production and possible restocking of working inventories could be partially offset by greater reliance on direct melt scrap and potential drawdown of unreported inventories that likely accumulated in preceding years.

Project projections taken together indicate that mine production in 2011 will increase by about 740,000 t (4.6%); however, it is expected that the actual increase will be significantly lower as production disruptions from project delays, technical problems and labour and political unrest that have become the norm in recent years are expected to continue to reduce output. World refined copper production for 2011 (adjusted for production disruptions) is therefore projected to increase by only about 3.5% to 19.7 Mt. In 2012, it is anticipated that refined production will increase by about 5% following continued ramp-up of projects.

Metals Economics Group’s (MEG) recent Strategies for Copper Reserves Replacement: The Costs of Finding and Acquiring Copper study concludes that between 2001 and 2010 the top 23 global copper producers (those that mined at least 145,000 t of copper in 2010) replaced nearly 290% of the copper they produced. Almost all these companies have added enough reserves to keep ahead of production, maintaining strong pipelines of projects to ensure stable or increased copper production.

The major copper producers increased their aggregate annual production by 26% over the past ten years to 11 Mt in 2010 — 68% of world mine production. As of year-end 2010, these companies also held sufficient reserves for 34 years of production at the 2010 rate.

However, increasing production has exacerbated their need to add reserves and most major producers forecast further production increases in the coming years.

Based on 2010 production, the major producers each need to replace an average of almost 480,000 t of copper in reserves each year; and if their near-term growth plans bear fruit, this could increase to almost 650,000 t annually by 2016.

Globally, 62 significant copper discoveries (defined as a deposit containing at least 500,000 t of copper) have been reported so far in the 1999-2010 period, containing 229.1Mt of copper in reserves, resources, and past production. The Americas account for the greatest share of copper in these discoveries, which is not surprising given that the Americas have been the primary focus of discoveryoriented exploration spending.

Although the copper found in the 62 discoveries is slightly more than the industry has produced over the past decade, the economic viability of these deposits relies to a large extent on location, politics, capital and operating costs, and market conditions, which inevitably reduce the amount of resources that will reach production. Considering that just 6% of copper in these discoveries has been upgraded to reserves so far, that many of the larger discoveries are low grade, and that almost half the copper in the discoveries is located in areas of medium or high political risk, the amount of copper available for production in the near term is likely far less than has been found.

Only ten of the 23 major producers have made significant copper discoveries since 1999; of the 62 discoveries made, 24 can be attributed to these ten companies, accounting for 41% of the 229.1 Mt total in-situ value found. Given that just 6% of copper in the 62 discoveries has so far been converted to reserves, it is clear that we know the majors have added almost all of their explorationderived reserves at existing mines and older projects, but very little of it through new discoveries.

The study addresses key growth strategy issues facing the copper mining industry and compares the relative costs per pound of discovering or acquiring copper in the ground.

In addition to an industry-wide review of the copper pipeline, acquisition activity, copper exploration spending, and major discovery successes, the study also provides a variety of metrics for measuring and comparing the relative costs of various growth strategies for the 23 largest copper miners and the industry as a whole.

Bechtel and Xstrata have a strategic alliance for the Standard Concentrator Project. This is a first in the copper sector and aims to speed up project execution and provide costs savings across multiple projects. Xstrata is among the world’s top five mined and refined copper producers and has approved this strategic alliance with Bechtel to cover a 10-year period.

Bechtel International will perform EPCM and or EPC services as required for all Xstrata Copper greenfield projects. The Bechtel alliance provides Xstrata with the proven management, technical expertise and construction management skills needed for development of multi-billion dollar projects.

CiDRA’s SONARtrac flow monitoring systems have been chosen as the best technology fit for the critical slurry lines within all five projects, which are Antapaccay in Peru, Las Bambas in Peru, El Pachon in Argentina, Tampakan in the Philippines, and Frieda River in Australia. CiDRA has completed shipment of sonar flow meters to the Antapaccay mine, which is nearing production. Bechtel has designed a standard concentrator that will be used in all of the five projects. The use of a standard concentrator in multiple copper concentrator projects will have significant benefits for Xstrata, including engineering, procurement, vendor submittal, construction and start-up efficiencies, as well as cost savings and reduced operating costs.

CiDRA Minerals Processing’s SONARtrac systems have also recently been chosen by Rio Tinto as its preferred technology for use on slurry lines at Oyu Tolgoi in Mongolia. CiDRA will instrument 30 lines at the new concentrator, where they will provide increased accuracy and reduced maintenance costs. OT is currently constructing a copper concentrator, related facilities and the necessary infrastructure to support an initial throughput of 100,000 t/d of ore. By 2017, an expansion of the concentrator is expected to be completed in conjunction with the ramping up of the Hugo North underground mine. This will provide capacity to process 160,000 t/d for the duration of the operation. SONARtrac systems were chosen because of the non-invasive design, “which provides exceptionally high reliability, performance, and maintenance-free operation, thus lowering operating costs and total cost of ownership,” CIDRA reports.

Copper flows

To counter declining ore grades, mining companies have looked to increase copper production by improving plant throughput and processing efficiency with larger mill circuit pump sizes. While it is possible to use multiple, smaller pumps to do the job of one large pump, it requires more plant floor space and more maintenance time. Weir Minerals has responded to the need for larger pumps in the market place and has been one of the few slurry pump suppliers willing to invest in expensive rubber manufacturing tooling and presses to produce these large pumps with state of the art rubber lined pump designs.

Warman MC pumps are specifically designed for the most severe slurry applications, such as AG and SAG mill cyclone feed. They easily manage large size particles in dense abrasive slurries and are also well suited for use as slurry transfer pumps on arduous applications such as gravel dredging or coarse coal cyclone feed.

The Warman rubber-lined MCR pumps have an outer ductile iron casing which supports replaceable rubber liners. This construction provides the full pressure rating of the pump throughout the service life as the rubber linings wear down and avoids the risk of pump explosion. The rubber linings are lighter than metal wear parts, making maintenance operations easier and safer. Rubber has proven to provide superior abrasion resistance to expensive chrome alloys in mill circuit pumps, which increases pump service life and reduces plant downtime, making them ideal for the demands.

Sain bnuu?

ReplyDeleteene niitelsen medeelliig eh survaljiig n duridaad ediin zasgiin chigleliin setguul deer tavij niitlej boloh uu??

ih taalagdlaa

bolnoo, nad ruu mail bicheerei.

Delete