Mongolia: what drives the togrog?

Before the global financial crisis (GFC), Mongolia’s central bank, Mongol Bank, heavily managed the togrog-US dollar exchange rate. We have ascribed aspects of the economy’s performance, in particular the very rapid growth in the money and credit aggregates, to MB’s failure to allow the togrog to appreciate more when commodity prices began to rise in 2002. Overly accommodative monetary conditions fuelled a credit boom. The economy’s vulnerability was harshly exposed when commodity prices plunged in the second half of 2008.

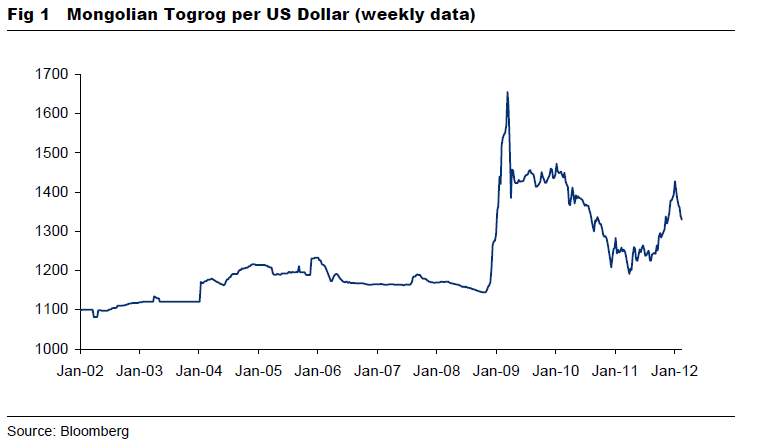

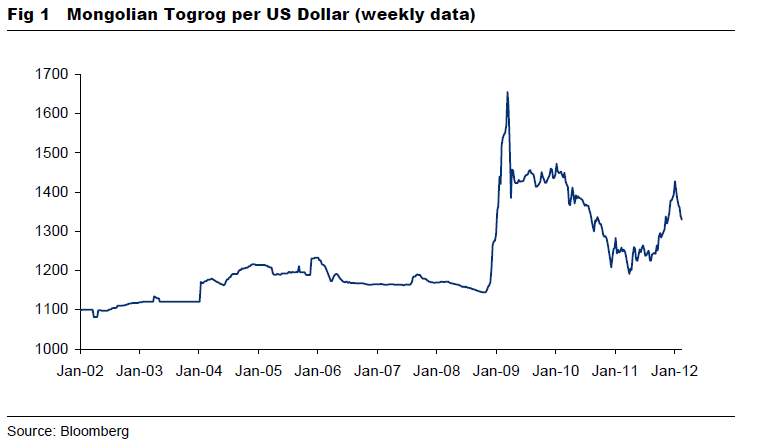

We think the authorities at Mongol Bank have changed their behaviour since the GFC. A glance at Figure 1, which depicts the togrog-USD exchange rate, suggests it has been more volatile since the GFC. More rigorous statistical analysis confirms this. The standard deviation of the exchange rate was 36.7 in the pre-GFC period (2002 until June 2008) and 82.8 after (July 2009 until the latest data). The increase in volatility is statistically significant.

However, with MB having relaxed its control over the togrog-USD exchange rate and market forces now allowed greater sway, the question arises, what market forces? The natural place to look is commodity prices. Mineral exports – notably coal, copper, iron ore, gold and zinc – comprise over 80 percent of exports. The togrog is a commodity currency.

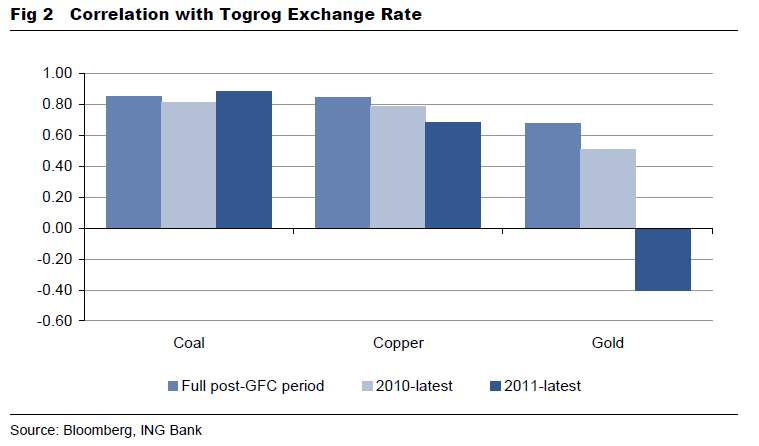

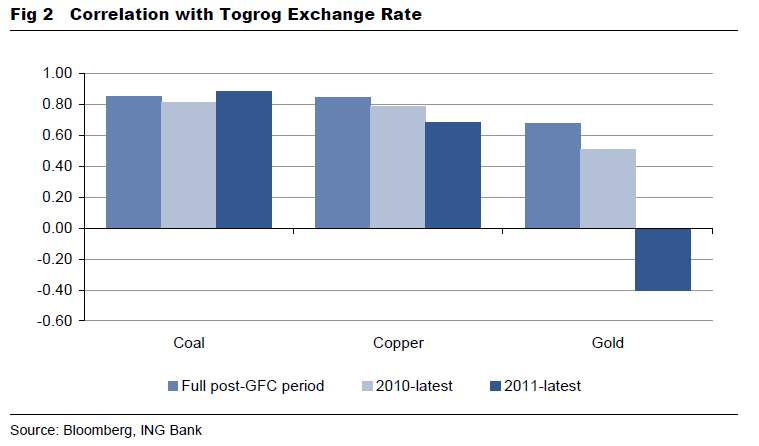

Figure 2 presents correlation coefficients for the togrog against the international prices of three commodities, coal, copper and gold during the post-GFC period. Coal prices are most consistently highly correlated with the exchange value of the togrog. For the full period, July 2009 until the latest data, coal and copper prices are highly correlated, 0.85, with the togrog. The correlation between the togrog and the international gold price is low at 0.68.

The correlation coefficients for all commodity prices decline when the period is truncated by six months to start in 2010. However, the togrog’s correlation with the coal price falls less than its correlation with the copper price (Fig 2). When the period is further truncated to start in 2011 the correlation between the togrog and the coal price actually increases to 0.88 while its correlation with the copper price falls further to 0.69. The togrog is negatively correlated with the international price of gold during the final subperiod.

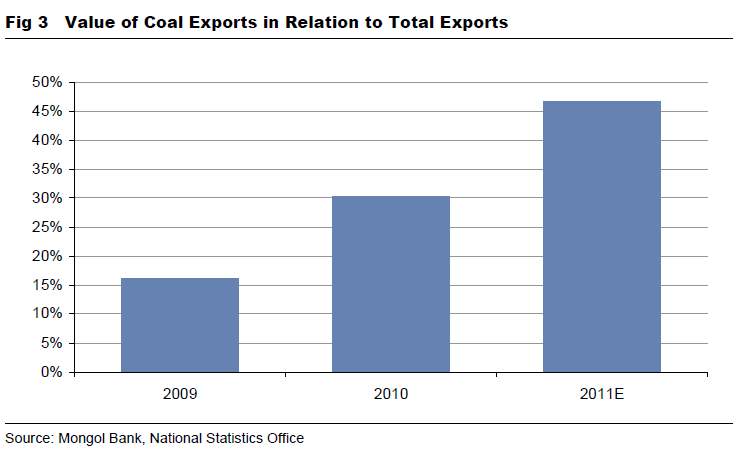

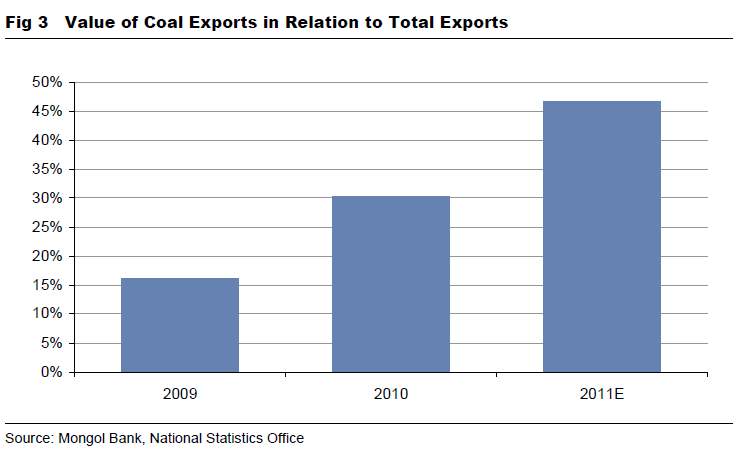

There is a good reason for the increase in the correlation between the togrog and the international coal price as the time period shortens. Coal has significantly increased in prominence among Mongolia’s exports. Coal accounted for a mere 16 percent of exports in 2009. By 2011 we estimate its share had increased to nearly half (Fig 3).

The surge in coal’s prominence is attributable to several factors. The international coal price has rebounded from its GFC low. Production from new mines also has increased. And demand from China has risen due to supply factors – the closure of small, environmentally unfriendly mines – and demand factors – six percent- seven percent forecast annual growth in crude steel and pig iron production. Tavan Tolgoi, the world’s largest untapped coal deposit, stands out among the new mines coming onstream in Mongolia. Production from Tavan Tolgoi was responsible for Mongolia supplanting Australia as the largest exporter of coking coal to China last year. The forecast production ramp-up at Tavan Tolgoi from an estimated 16 million tons in 2012 to 40 million tonnes a year by 2020 will sustain coal’s prominence among foreign exchange earners.

We believe the economic bust during the GFC persuaded the authorities at Mongol Bank to allow market forces greater sway in determining the togrog exchange rate. International commodity prices are the principal market force driving commodity currencies like the togrog. Coal’s increasing prominence in Mongolia’s export bundle – by 2011 it accounted for nearly half of all exports – has given the international coal price pride of place among market forces. Bright prospects for the Mongolian coal industry suggest the coal price will retain its position.

Tim Condon is the Asia chief economist at ING Bank

Contact The Asset

© Asset Publishing and Research Limited

All rights reserved. No unauthorized reproduction by any means.

We think the authorities at Mongol Bank have changed their behaviour since the GFC. A glance at Figure 1, which depicts the togrog-USD exchange rate, suggests it has been more volatile since the GFC. More rigorous statistical analysis confirms this. The standard deviation of the exchange rate was 36.7 in the pre-GFC period (2002 until June 2008) and 82.8 after (July 2009 until the latest data). The increase in volatility is statistically significant.

However, with MB having relaxed its control over the togrog-USD exchange rate and market forces now allowed greater sway, the question arises, what market forces? The natural place to look is commodity prices. Mineral exports – notably coal, copper, iron ore, gold and zinc – comprise over 80 percent of exports. The togrog is a commodity currency.

Figure 2 presents correlation coefficients for the togrog against the international prices of three commodities, coal, copper and gold during the post-GFC period. Coal prices are most consistently highly correlated with the exchange value of the togrog. For the full period, July 2009 until the latest data, coal and copper prices are highly correlated, 0.85, with the togrog. The correlation between the togrog and the international gold price is low at 0.68.

The correlation coefficients for all commodity prices decline when the period is truncated by six months to start in 2010. However, the togrog’s correlation with the coal price falls less than its correlation with the copper price (Fig 2). When the period is further truncated to start in 2011 the correlation between the togrog and the coal price actually increases to 0.88 while its correlation with the copper price falls further to 0.69. The togrog is negatively correlated with the international price of gold during the final subperiod.

There is a good reason for the increase in the correlation between the togrog and the international coal price as the time period shortens. Coal has significantly increased in prominence among Mongolia’s exports. Coal accounted for a mere 16 percent of exports in 2009. By 2011 we estimate its share had increased to nearly half (Fig 3).

The surge in coal’s prominence is attributable to several factors. The international coal price has rebounded from its GFC low. Production from new mines also has increased. And demand from China has risen due to supply factors – the closure of small, environmentally unfriendly mines – and demand factors – six percent- seven percent forecast annual growth in crude steel and pig iron production. Tavan Tolgoi, the world’s largest untapped coal deposit, stands out among the new mines coming onstream in Mongolia. Production from Tavan Tolgoi was responsible for Mongolia supplanting Australia as the largest exporter of coking coal to China last year. The forecast production ramp-up at Tavan Tolgoi from an estimated 16 million tons in 2012 to 40 million tonnes a year by 2020 will sustain coal’s prominence among foreign exchange earners.

We believe the economic bust during the GFC persuaded the authorities at Mongol Bank to allow market forces greater sway in determining the togrog exchange rate. International commodity prices are the principal market force driving commodity currencies like the togrog. Coal’s increasing prominence in Mongolia’s export bundle – by 2011 it accounted for nearly half of all exports – has given the international coal price pride of place among market forces. Bright prospects for the Mongolian coal industry suggest the coal price will retain its position.

Tim Condon is the Asia chief economist at ING Bank

Contact The Asset

© Asset Publishing and Research Limited

All rights reserved. No unauthorized reproduction by any means.

Comments

Post a Comment